Sunshine, palm trees, and clear blue skies Florida is famous for many things, but lately, a new trend is cruising down its highways. Dash cams are rapidly becoming must have gadgets for drivers across the state. As these compact cameras clip onto windshields and start recording, they transform how Floridians drive and how insurers handle claims. The ripple effects are being felt from Miami to Orlando, making the highways safer and Florida auto insurance disputes a thing of the past. Let’s take a closer look at how dash cams are reshaping the insurance landscape in the Sunshine State.

Dash Cams Take the Sunshine State by Storm

Dash cams, once reserved for professional drivers and auto enthusiasts, now appear regularly on Florida’s busy roads. Retailers report sales soaring, with more Floridians investing in these small but mighty devices than ever before. The allure? Instant access to video proof during a crash, a fender bender, or even a simple parking lot mishap.

Drivers cite multiple reasons for the surge, from deterring would be scammers to capturing scenic drives along the coast. Social media buzz and viral dashcam footage have fueled curiosity, prompting everyone from college students to retirees to hop on the bandwagon. The technology has become increasingly affordable and user friendly, making it accessible to a broad audience.

Florida auto insurance agents throughout the state have noticed the trend, too. Some even report prospective clients asking if dashcam ownership leads to lower premiums or smoother claims. This growing interest is changing the narrative around road safety and personal responsibility, with more drivers eager to take control of their on the road stories.

DashIt’s cams are more than just a fleeting fad in Florida. They’re a cultural shift empowering everyday motorists with power, protection, and peace of mind.

Crystal Clear Evidence: Cameras Capture the Truth

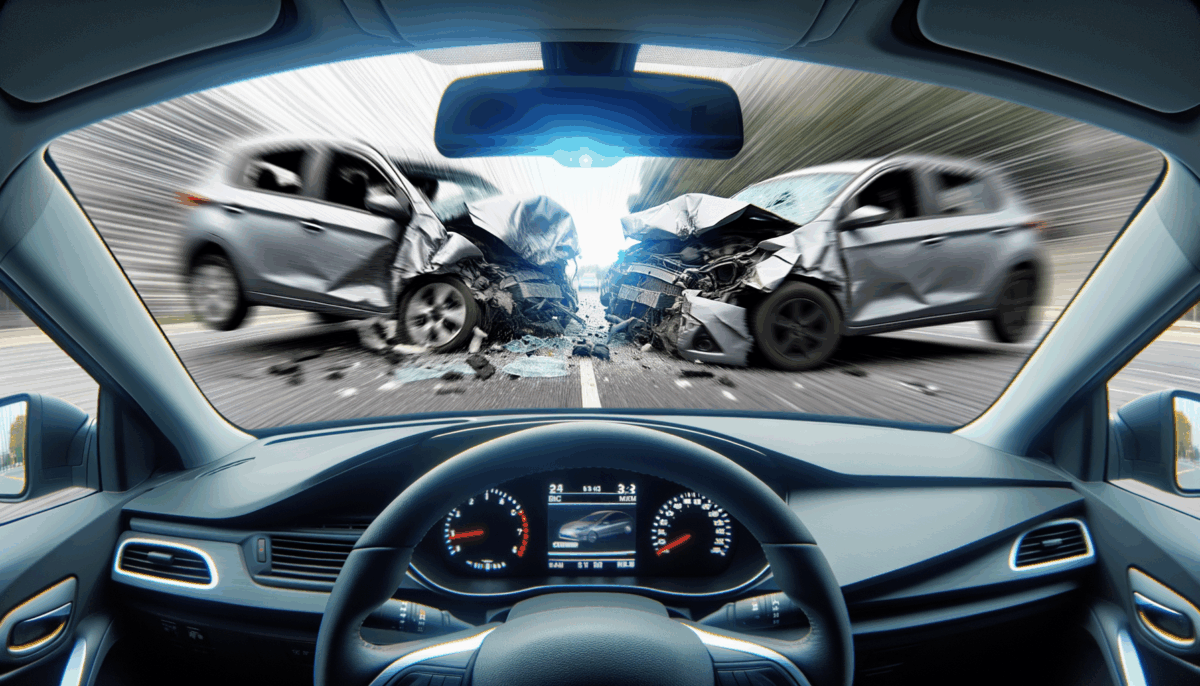

Nothing tells a story quite like a video. When accidents happen, conflicting accounts can make it tough for investigators and insurance adjusters to figure out what happened. Enter the dash cam: the unbiased eyewitness that never blinks. These devices record every second, providing clear evidence when it matters most.

For Florida drivers, this means less stress following a collision. Instead of relying solely on memory or witness statements, they can present a digital timeline of events. Dashcam footage now resolves Florida auto insurance claims that once dragged on for weeks due to “he said, she said” disputes.

Law enforcement has welcomed this clarity, too. Officers can quickly review footage, eliminating doubts and reducing paperwork. In cases where fraud or staged accidents are suspected, a growing problem on Florida’s roads, dash cam evidence can be the difference between justice and injustice.

Ultimately, dash cams transform how drivers establish the truth after accidents. Their impartial and precise recordings ensure that honest drivers are protected and fraudulent claims are exposed.

How Dash Cams Are Speeding Up Florida Auto Insurance Claims

For decades, Florida drivers dreaded the auto insurance claims process. Endless paperwork, phone tag with adjusters, and lengthy investigations made getting compensation feel like a marathon. Dash cams are changing all that fast.

The process shifts into high gear when drivers file a claim supported by video footage. Adjusters no longer have to piece together events from inconsistent statements or fuzzy recollections. Instead, they can review the incident frame by frame, making decisions in days rather than weeks.

This speed benefits everyone involved. Drivers complete repairs sooner and are back on the road with minimal inconvenience. Florida auto insurance companies save resources and reduce costly claim backlogs, ultimately leading to happier customers and improved reputations.

What’s more, the presence of dashcam footage discourages Florida auto Popularizing Dash Cams Influence on Florida auto insurance Claims insurance fraud, a persistent problem in Florida. With fewer fraudulent claims to investigate, insurers can focus on delivering prompt service to honest policyholders, making the entire process more efficient and less stressful.

Safer Roads, Happier Drivers: The Tech Advantage

Beyond simplifying Florida homeowners insurance claims, dash cams quietly make Florida’s roads safer. Knowing that every move is recorded on camera, drivers often drive more cautiously and courteously, a behavior shift known as the “observer effect,” according to psychologists. This subtle shift in behavior cuts down on risky driving and road rage.

Some dashcams have advanced safety features, such as lane departure warnings and collision alerts. These high tech helpers are like having a vigilant copilot, nudging drivers toward safer habits and helping prevent accidents before they occur.

The broader impact is clear: fewer accidents mean less congestion, lower insurance rates, and a safer driving environment. Families, commuters, and tourists are reaping the benefits of technology designed to protect and empower.

Ultimately, dash cams help foster a culture of accountability and positivity on Florida’s roads. With every safe trip and successfully resolved claim, drivers become more confident and enthusiastic about embracing the digital future.

Florida Auto Insurance Companies Get Onboard the Dash Cam Trend

Florida auto insurance companies are taking notice as more Floridians equip their cars with dash cams. Some insurers now actively encourage drivers to install cameras, occasionally offering policy discounts or special perks for submitting dash cam footage during claims.

Forward thinking companies recognize that dashcams can significantly reduce fraudulent claims, a chronic headache in the industry. With clear evidence, adjusters can spot staged accidents and dishonest reports, saving millions in annual wrongful payouts.

Insurers are also exploring how dashcam data can enhance customer service. These companies build stronger relationships with their clients by quickly resolving disputes and accelerating claims approval. Some are even piloting dedicated dash cam upload portals, making it easier than ever to submit video evidence.

There’s a growing partnership between drivers and insurers, with dash cams symbolizing a shared commitment to safety and honesty. As the trend grows, more Florida auto insurance providers increasingly integrate dashcam policies into their core offerings.

A Glimpse Ahead: The Future of Florida Auto Insurance Claims

As dash cams become standard on Florida’s roads, the future of insurance claims looks brighter than ever. Industry experts predict that within a few years, submitting video evidence will be as routine as snapping photos after an accident. Digital claims, streamlined by technology, will soon be the norm.

Artificial intelligence may further enhance the process, analyzing footage to assess fault, calculate damages, or even detect signs of impaired driving. Insurers could develop instant claim settlements, sending payments within hours instead of days, all triggered by a dashcam’s file upload.

Automakers are already taking note, with some planning to integrate dash cam features directly into new vehicles. This seamless approach could make every Florida driver participate in a digital safety network, helping prevent accidents and promote accountability.

The road ahead holds exciting possibilities. As technology evolves, Florida’s drivers and insurers alike stand to benefit from a future where transparency, safety, and trust rule the day.

Dash cams are more than just gadgets. They’re allies for Florida drivers and essential tools for modern insurers. As they capture the truth, speed up claims, and encourage safer driving, these cameras reshape how we drive and resolve disputes under the Florida sun. With support from motorists and Florida auto insurance companies, the dash cam revolution is here to stay, paving the way for a safer, brighter, and more honest future on the Sunshine State’s roads.